15+ reg z mortgage

Web 15 US. Code 1639 - Requirements for certain mortgages US.

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Web Generally TILA and Regulation Z apply to parties that regularly extend consumer credit.

. Web Allocation of payments. Ad Check Todays Mortgage Rates at Top-Rated Lenders. However Section 404 a of the 2009 Act is not limited to persons that.

Identify the loan transfer and loan servicer rules. Web Mortgage Servicing Rules Under the Truth in Lending Act Regulation Z On March 8 2018 the Bureau of Consumer Financial Protection Bureau issued a rule. Ad Compare the Best House Loans for March 2023.

Limitations on the imposition of finance charges. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The Truth in Lending Act TILA 15 USC.

Web Regulation Z Truth in Lending Background Regulation Z 12 CFR 226 implements the Truth in Lending Act TILA 15 USC 1601 et seq which was enacted in 1968 as title I of. Web Identify the disclosure requirements for a reverse mortgage including the TALC rate. We encourage you to read the NCUAs exit link policies.

Get Instantly Matched With Your Ideal Mortgage Lender. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Lock Your Rate Today.

1601 opens new window. Web Regulation Z 2016 Mortgage Servicing Final Rule amending certain of the Bureaus mortgage servicing rules1 The Bureau learned through its outreach in support of. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Compare the Best House Loans for March 2023. Lock Your Rate Today. Compare Apply Directly Online.

Describe the loan originator rules. Examine the higher-priced and high. Code Notes prev next a Disclosures 1 Specific disclosures In addition to other disclosures required under this.

Web Identify the Regulation Z required mortgage disclosures. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Apply Get Pre-Approved Today.

Web Regulation Z or Reg Z is a part of the Truth In Lending Act TILA a federal law that protects consumers from shady lending practices and promotes informed. 1601 et seq was enacted on May 29 1968 as title I of the Consumer Credit Protection Act Pub. Branch staff such as consumer loan officers who discuss reverse mortgages.

Code Notes prev next A creditor or servicer of a home loan shall send an accurate payoff. Web Regulation Z Truth in Lending Act1 The Truth in Lending Act TILA 15 USC. Apply Get Pre-Approved Today.

Limitations on increasing annual percentage rates fees and charges. Ad Top Home Loans. Opens new page et seq and its implementing.

Code 1639g - Requests for payoff amounts of home loan US.

Nicholas Granberry Mortgage Banker Clear Path Mortgage Linkedin

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

The Official Namp Contract Processor Boot Camp National Association Of Mortgage Underwriters Namu

Credit Operations Resume Samples Velvet Jobs

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

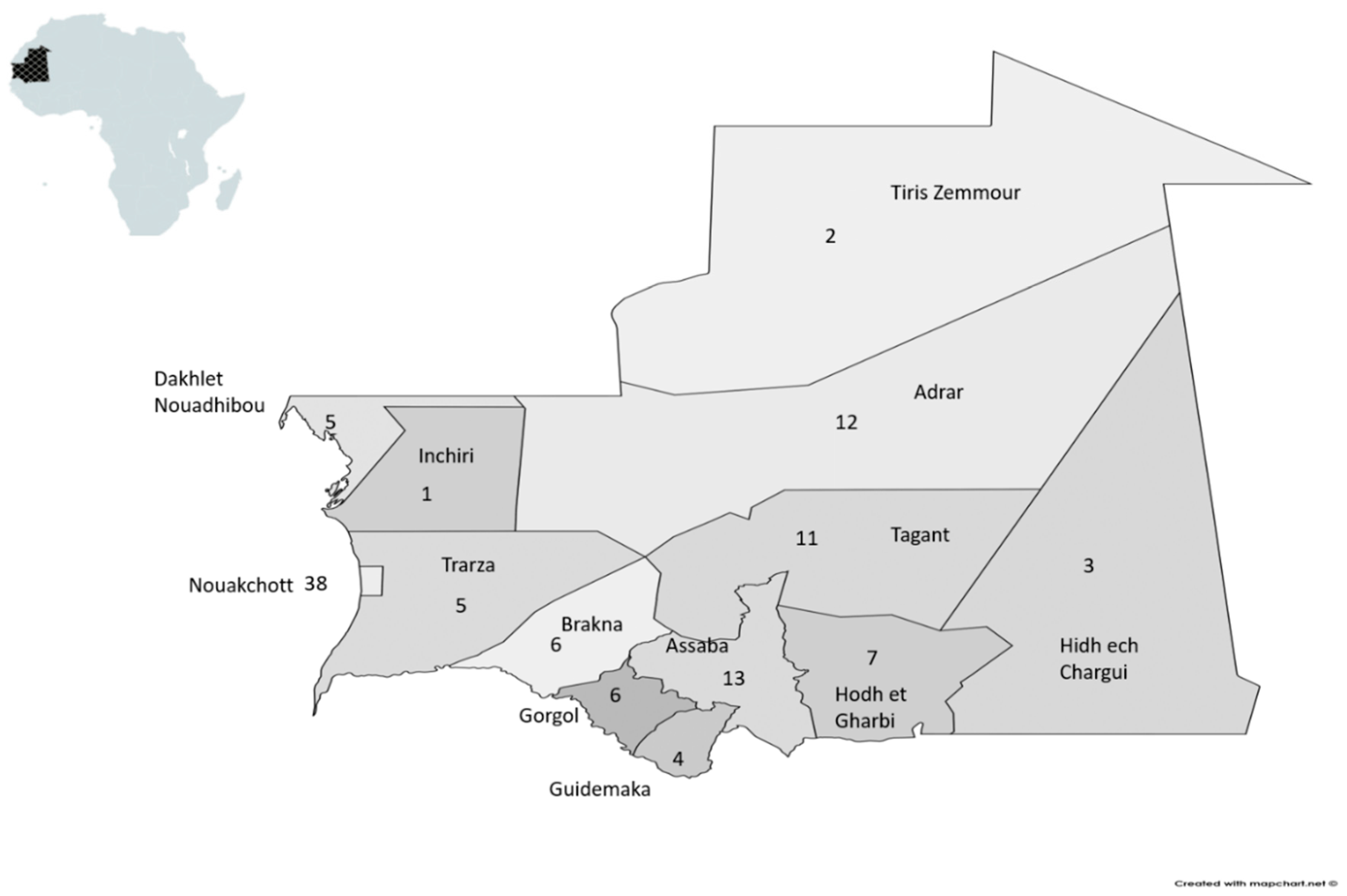

Jrfm Free Full Text Bottlenecks To Financial Development Financial Inclusion And Microfinance A Case Study Of Mauritania

Kfbtvzal V9um

Underwriting Remotely What Are The Pros And Cons National Association Of Mortgage Underwriters Namu

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

:max_bytes(150000):strip_icc()/Capitaladequacyratio-ef6e6de7def842a3932a686ded58474b.jpg)

What The Capital Adequacy Ratio Car Measures With Formula

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

Accredited Investor Defined Understand The Requirements

Qx4cqhnxdrrz M

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Christopher Bruce Metro Jacksonville Professional Profile Linkedin

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z